Company A sells machinery to Company B for $300,000, with payment due within 30 days. Alternatively, the note may state that the total amount of interest due is to be paid along with the third and final principal payment of $100,000. For example, if a business wants to borrow $7,000, Square might charge a total of $7,910 for the loan. Upon approval, the $7,000 is deposited into the business’s checking account the next day and then Square charges 9% of the business’s credit card sales each day until the $7,910 is fully paid. Square says that the advantage of this percentage-of-sales method is that the business does not have to make large payments when business is slow. The percentage that Square charges stays constant until the loan is paid off fully.

Like all assets, debits increase notes receivable and credits reduce them. The A/R balance is decreased as payments are applied to sales invoices. Recording Notes Receivable Transactions The below video provides 3 examples that take you through the process of accounting for or recording a notes receivable transaction.

Format of Notes Receivable

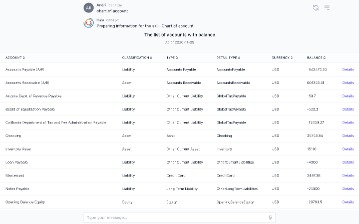

The most effective way to evaluate A/R balances is to combine the totals

all account receivable accounts. Complete the following steps to

reconcile accounts receivable balances. The payee is the party who receives payment under the terms of the note, and the maker is the party obligated to send funds to the payee. The amount of payment to be made, as listed in the terms of the note, is the principal. The $18,675 paid by Price to Cooper is called the maturity value of the note.

Euro area and national quarterly financial accounts – Quality report … – European Central Bank

Euro area and national quarterly financial accounts – Quality report ….

Posted: Mon, 15 May 2023 07:00:00 GMT [source]

Sometimes the maker of a note does not pay the note when it becomes due. The maturity date of a note receivable is the date on which the final payment is due. Furthermore, by transferring the note to Accounts Receivable, the remaining balance in the notes receivable general ledger contains only the amounts of notes that have not yet matured. In any event, the Notes Receivable account is at the face, or principal, of the note. No interest income is recorded at the date of the issue because no interest has yet been earned. When a note is received from a customer, the Notes Receivable account is debited.

The Difference Between Interest Receivable & Interest Revenue

Maturity value is the amount that the company (maker) must pay on a note on its maturity date; typically, it includes principal and accrued interest, if any. At this point, the note should be transferred to an open account receivable. Accounts Receivable is debited for the full maturity value, including https://kelleysbookkeeping.com/what-should-you-do-if-you-receive-an-irs-cp504/ the principal and unpaid interest. This is because not all the sales made to a particular customer are recorded in the customer’s subsidiary accounts receivable ledger. For example, the maker owes $200,000 to the payee at a 10% interest rate, and pays no interest during the first year.

- This is because not all the sales made to a particular customer are recorded in the customer’s subsidiary accounts receivable ledger.

- Promissory notes are written promises to pay a specific amount of money (such as repayment of a loan).

- A Show Overdue Invoices

Only option can be enabled to only show invoices that are overdue. - Examples of notes receivable include employee cash advances with a written promise to pay and uncollected trade accounts receivable (sales owed to a company on credit) converted into promissory notes.

At the end of the three months, the note, with interest, is completely paid off. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The ability to raise cash in this way is important to small and medium-sized businesses, which may have limited access to finance.

Recording Notes Receivable Transactions

Many businesses sell their products or services to customers on credit. They simply send an invoice to the customer after the sale and the customer (theoretically) pays it. However, some transactions are better completed with a more formal promise to pay, called a promissory note.

In addition, notes receivable can potentially be sold to third parties. By reducing unpaid, “bad” debts, collecting interest income and facilitating contract sales, notes receivable can be a tool for enhancing cash flow. A company that frequently exchanges goods or services for notes would probably include a debit column for notes receivable in the sales journal so that such transactions would not need to be recorded in the general journal.

Example of Journal Entries for Notes Receivable

The Schedule of Accounts Receivable report can be dated based on past

monthly periods. This report can be used to list AR details

based on the end of past years, quarters, or months. The EBMS software facilitates the ability to create multiple accounts

receivable financial accounts.

Remember from earlier in the chapter, a note (also called a promissory note) is an unconditional written promise by a borrower to pay a definite sum of money to the lender (payee) on demand or on a specific date. A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator. Also, a business may give a note to a supplier in exchange for merchandise to sell or to a bank or an individual for a loan.